It’s probably a safe bet that you didn’t pursue a career in engineering because - deep down inside - you really loved accounting.

While reporting on software capitalization may seem like a daunting task, with just a little bit of practical guidance, you can enhance cost visibility for your finance team, effectively navigate compliance landmines, and <insert drumroll> protect your roadmap from getting disrupted.

Let’s get to it.

What Is Software Capitalization?

Software capitalization is an accounting practice that allows companies to treat their software development costs as assets rather than expenses. Rather than recording these investments entirely as operating costs in the current period, you capitalize them (which means spreading them across the useful life of the software).

By treating your software costs as assets, you're acknowledging the long-term value of your work. This approach not only improves your EBITDA (which stands for “Earnings Before Interest, Taxes, Depreciation, and Amortization”) and cash flow but also provides your finance team with a clear view of your R&D strategy so they can better plan on how to support you come budget season.

So buck up—this is more than just a chore; it’s the first step in bridging the knowledge gap between your developers and your finance team. Trust me, that will pay off when it comes time to submit budgets and hiring plans.

What is the Difference Between Internal-Use & External-Use Software?

Internal-use software refers to applications used by your team as part of your engineering workflows, such as your DevEx platforms, CI/CD tooling, or Copilot licenses. External-use software, on the other hand, is what your team builds for commercial purposes. The first step in any software capitalization policy is determining whether the asset should be coded as internal-use software or external-use software.

Internal-use software is everything your team uses to build products, but it is not a core part of the software that you sell to customers. According to GAAP software capitalization rules, you can capitalize any costs incurred during development immediately after confirming that the technology is a solution for your team. So, if you are onboarding a new tool, all you have to do is determine that it fits your use case, and you can begin amortizing the purchase.

External-use software is everything from a SaaS product to an embedded system that will be a part of what is sold or marketed to your customers. Everything from your AWS hosting costs to a subscription for a 3rd party billing tool that you use to track and charge for usage in your product would qualify as external-use software. In these cases, capitalization starts only after you have determined technological feasibility for commercialization purposes, such as a prototype.

Distinguishing between these two categories is necessary for maintaining accurate records, passing audits, and ensuring software capitalization compliance, so make sure you get your classification right.

What are the GAAP Rules for Software Capitalization?

U.S. GAAP rules outline three distinct stages of the software development process:

- Preliminary Project Stage – Early conceptual work, such as a PRD. Expenses incurred here cannot be capitalized.

- Application Development Stage – Initial coding, testing, and implementation. Costs incurred here can be capitalized.

- Post-Implementation Stage – Training and ongoing maintenance. Costs here can be capitalized as well.

As an engineering leader, you need to commit these to memory now. Understanding these rules is the second step in establishing software capitalization best practices in your organization.

For modern engineering teams, aligning work against these stages requires some effort since development doesn’t always follow perfectly linear phases. However, maintaining compliance with GAAP software capitalization rules is not a creative exercise, as it affects everything from your company’s financial reporting to investor relations and tax obligations.

How Can I Capitalize Software Costs in Agile Environments?

To effectively manage software capitalization in agile environments, it's best practice to:

- Label sprints as “preliminary,” “development,” or “post-implementation” based on project phase

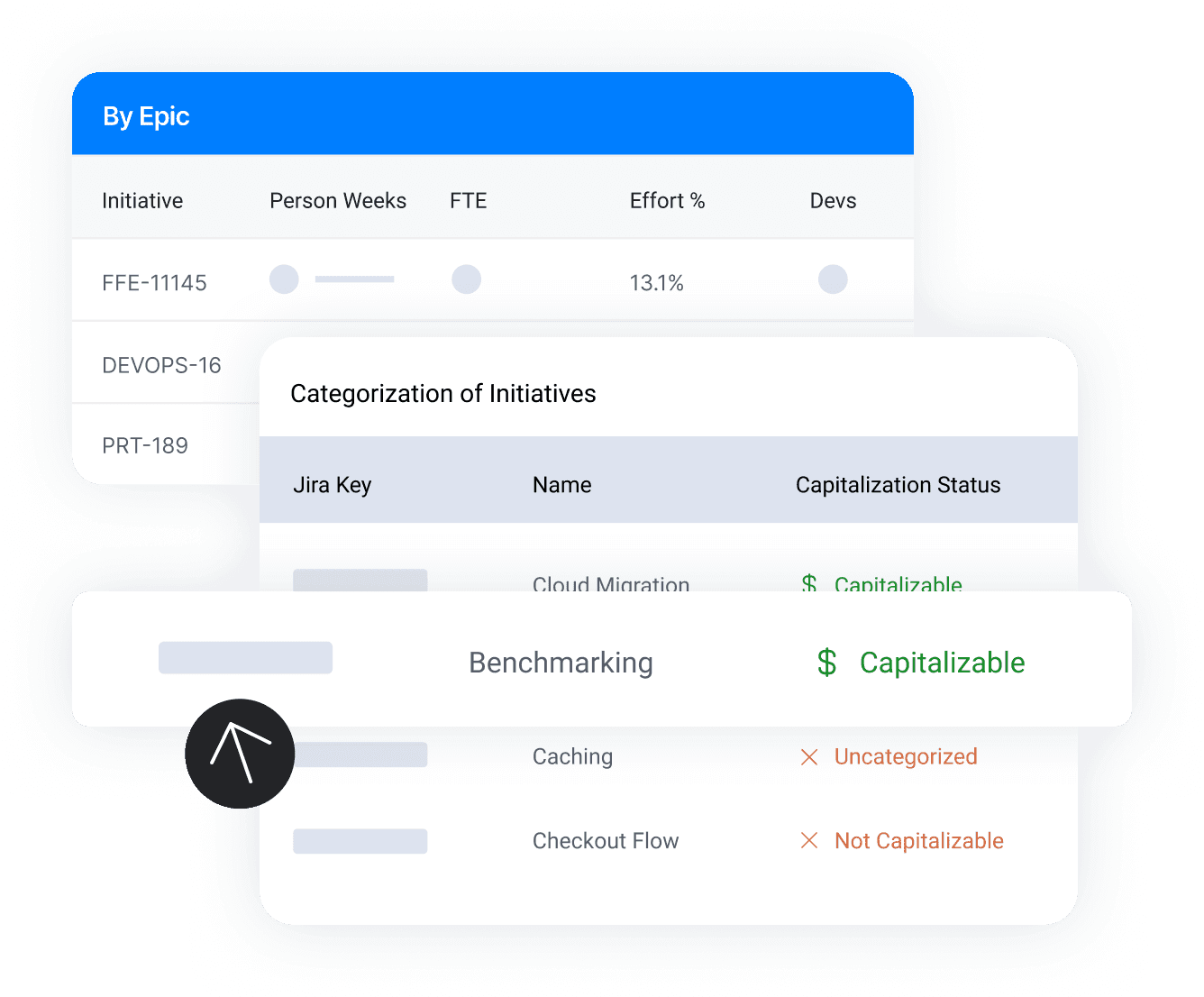

- Use tools like JIRA and LinearB to tag tasks and issues based on capitalization status and quickly report on them.

- Enforce workflows that log sprint activity in audit-ready formats.

This is where it gets interesting because these practices not only allow you to pass an audit by showing exactly how your teams comply with GAAP software capitalization rules, but they also help provide a framework that leads to better sprint management.

Agile development practices don’t map neatly to traditional financial frameworks. As any engineering leader will attest, agile is fluid by nature: sprint goals change, features evolve, and deployment is continuous.

To determine when work shifts from exploratory to actually being capitalizable, engineering and finance need to become BFFs. In order to clearly mark the end of the preliminary stage, you’ll need defined transition points—for example, a signed-off architecture vs. a fully validated prototype.

What are the Most Common Software Capitalization Challenges?

Teams that attempt to implement software capitalization often hit a few predictable roadblocks during their first iteration:

- Establishing technological feasibility can be highly subjective without formal checkpoints and clearly defined entrance & exit criteria.

- Estimating the useful life of software is increasingly complicated due to rapid innovation cycles (see: AI).

- Keeping documentation consistent across product, engineering, and finance can be a real headache.

- Post-launch activities are easy to misclassify, which can lead to overcapitalization.

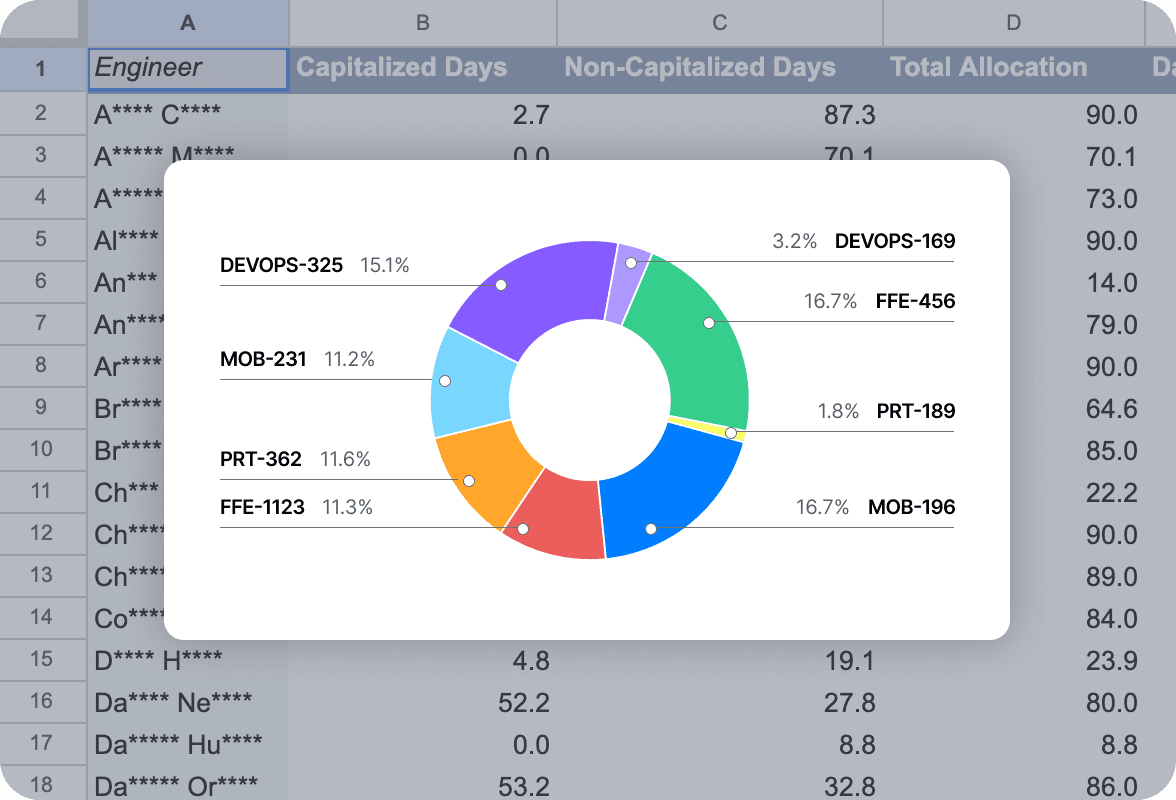

The right system requires regular reviews with automated tracking to reduce the risk of misreporting, improve traceability, and ensure that every capitalized expense can withstand audit scrutiny. This is where automating your R&D Cost Capitalization reports with a platform like LinearB becomes crucial to maximize visibility with your finance team.

What is the Difference Between CapEx & OpEx in Software Development?

Another fundamental distinction when accounting for software development is deciding whether a particular cost should be coded as a capital expense (CapEx) or an operating expense (OpEx). Here’s the difference:

- CapEx includes all of the development costs that contribute to building your product.

- OpEx includes ongoing costs like support, training, and bug fixes.

Misclassifying R&D software costs can lead to financial misstatements and compliance failures, so you have to be sure to get this right.

What are the Tax and Compliance Considerations When Calculating Cost Cap?

Software capitalization has profound implications for your company’s tax reporting. Under recent changes to the U.S. tax code (Section 174), certain R&D activities must be capitalized and amortized, even if they were previously expensed. Examples include developing a database schema or integrating third-party services like Stripe or Auth0.

Aligning to GAAP and IRS standards may be a heavy lift, but it’s necessary. The risk of audit penalties skyrockets if you can’t produce the documentation required to support amortization schedules, feasibility milestones, and cost classifications.

How Can Software Capitalization Impact Developer Productivity?

Good software capitalization practices can actually help your devs be more productive. When engineering understands how their work is tracked and categorized, they can plan better, document smarter, and reduce the administrative overhead associated with many things beyond just financial reporting.

When using a tool like LinearB to help establish software capitalization workflows, you kill two proverbial birds with one stone:

- Your devs stop wasting time on manual time tracking due to Git-based automation.

- Managers can map sprint goals to capitalizable milestones.

- Execs can justify tooling or headcount decisions based on capitalized output.

In short, developer productivity and capitalization actually go hand in hand when teams are aligned and supported by the right tools, processes, and ceremonies.

6 Practical Steps for Implementing Effective Software Capitalization

- Define clear policies: Align on when capitalization begins, which costs qualify, and how development phases are tracked.

- Leverage automation tools: Connect Git, Jira, and other systems to automatically report capitalizable activity through platforms like LinearB.

- Document feasibility decisions: Treat these like any other project milestone. Sign-offs matter!

- Train teams on financial context: A little education goes a long way. If you explain the “why” clearly, most developers will respect the need to conform to these standards.

- Integrate with sprint planning: Label your work during sprint planning so cost categorization is built into the development flow.

- Align amortization schedules with product roadmaps: The amortization of software costs should always reflect real-world usage, not theoretical timelines.

We’re at a point where engineering output is under more scrutiny than ever—from boards, investors, regulators, and finance teams alike.

So, if you’re still tracking capitalizable work in spreadsheets—or not tracking it at all—now’s the time to rethink your approach. Whether you’re leading platform strategy or forecasting next quarter’s burn, understanding the tax implications of software capitalization, how it impacts productivity, and how to apply it in modern, agile environments is a bare necessity.

Ready to automate your software capitalization?

LinearB helps engineering teams automatically capture, classify, and report capitalizable work without disrupting your sprints.

From software capitalization in Agile environments to seamless finance integrations, LinearB perfectly aligns engineering and accounting.

Book a demo today and see how it works →